ITIN, or ITIN, also known as an individual taxpayer identification number (ITIN), is a tax processing number issued through the Internal Revenue Service (IRS), the department for income tax in the US. ITIN is a nine-digit number that always starts with the letter 9 and ends with the number 7 or 8 as the number 4, like 9XX-7XXXXX.

IRS Issues ITIN only to those who are required to possess a US taxpayer ID number but don’t possess or are not eligible to get a Social Security Number (SSN) from the Social Security Administration (SSA). ITINs permit individuals to comply with US tax laws and provide the ability to speedily manage and record taxes and tax payments to those who aren’t legally entitled to Social Security Numbers.

What Do You Do If You Lose Your ITIN Number?

Your ITIN isn’t like the Social Security number. This number is provided by IRS and is used only to identify the IRS. If you are unable to locate your ITIN, it is your responsibility to make contact with the IRS to retrieve it. Getting the ITIN back from IRS is straightforward if it hasn’t expired.

Make a call to the IRS toll-free number at 800-829-1040.

Complete the security questionnaire to confirm your identity

Follow the directions to get your ITIN.

If you cannot find your ITIN, and the IRScannoto provides you with your ITIN, it could be because it’s expired. It could happen because your ITIN wasn’t used to prepare an income tax return under the federal tax code in the past.

Suppose this is the situation; you’ll need to apply for an additional ITIN. The following section will provide how to apply for an updated ITIN.

How do I verify the status of my ITIN status?

It is possible to contact the IRS toll-free at 800-829-1040 if you live in the United States or 267-941-1000 (not a toll-free phone number) in case you’re outside of the United States. This service lets you examine how your applications are progressing within seven weeks after submitting Form 7, and you have filed your tax return.

How can I find out whether my request is in the process of being processed?

Making an application to be an ITIN is an essential procedure for filing tax returns, even if you don’t already have or don’t qualify to get an ITIN or a Social Security Number. Naturally, you’ll want to be aware of the process. Although IRS Internal Revenue Service typically advises applicants to wait for an additional 10 to 15 weeks for processing, most people receive a reply from the IRS within between six and eight weeks. Don’t forget, however, that you can call the IRS’s toll-free phone number and speak to agents who will help you verify what’s happening with your tax identification number.

Faster, Easier W-7 Application

In addition to information about how to check for your ITIN condition, ITIN W-7 Application offers many valuable features. One is that we simplify the application process with electronic forms and ITIN instructions for the W-7. This makes it less likely that you’ll make mistakes on the application due to our step-by-step guide, which helps you include the correct information on your application.

How long is the validity of an ITIN suitable for?

Three years ITINs that have not been used on a federal tax form at least once within the past 3 years expire in December. Furthermore, any ITIN issued before 2013 with middle numbers in the range of 88 (Example: (9XX-88-XXXX) will expire at the close of this year.

How do you keep an ITIN number valid for?

Three years If you’ve used an ITIN for three years, it will expire if you have utilized it at least once in the past three years. However, some ITIN holders who used their taxpayer identification numbers within the last three years might have to obtain an updated ITIN if it’s more than.

Will my fellowship be suspended if I don’t have an individual taxpayer identification number?

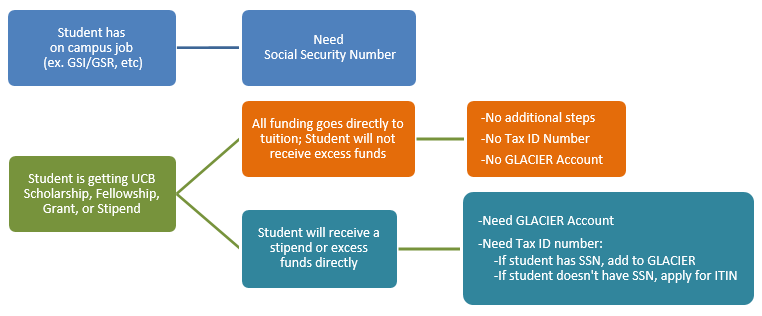

To comply with IRS tax regulations, You must provide the complete GLACIER tax documents for the Payroll Office and a complete ITIN application to the Berkeley International Office. Berkeley International Office will notify the Payroll Office that you have requested an ITIN. Payroll Office Payroll Office will then release the funds. Payroll Office of the UCB Payroll Office is allowed to issue the check before the IRS approves it. IRS has issued ITIN.

What happens if I get What happens if I receive a Social Security Number (SSN)?

From the IRS site:

“Once you receive a SSN, you must use that number for tax purposes and discontinue using your ITIN. It is improper to use both the ITIN and the SSN assigned to the same person to file tax returns. It is your responsibility to notify the IRS so we can combine all of your tax records under one identification number. If you do not notify the IRS when you are assigned a SSN, you may not receive credit for all wages paid and taxes withheld which could reduce the amount of any refund due.”

Does an ITIN Expire?

The IRS policy says that the Individual Taxpayer Identification Numbers expire when they are not included on the federal tax return over five years consecutively.

This means that, in other words, the IRS will not take away your ITIN if you’ve used it on at least one tax return within the last five years, and it will be in force until you stop using it to prepare US taxes.

This policy applies to any ITIN, and the goal is to ensure that anyone who legally uses an ITIN for tax-related purposes continues to use an ITIN for tax purposes.

Find out here if you need need to renew your tax ID.

How to Renew an Expired ITIN Number

If your ITIN has passed the expiration date or is scheduled to run out in 2020, your process to follow is pretty straightforward. Similar to seeking the ITIN for the first time in your life, you have to complete IRS Form W-7 Request to apply for an IRS Individual Taxpayer Identification Number, whether in person or via mail, together with the required identification documents. Unlike an application for the first time, you do not have to submit the taxpayer’s federal tax returns.