You may have received the income of a non-employment bank account that earned you interest. Or from an account at a brokerage firm that pays dividends stocks. You could have performed some freelancing as an independent contractor. Or you may have received unemployment benefits. Every type of income that is not earned by employment needs a specific form of 1099 form that will declare that income to the IRS for tax reasons.

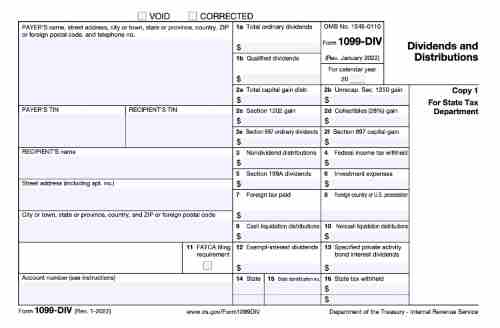

In this case, for example, independent contractors or freelancers earning an amount of $600 or more as non-employment earnings should be issued a 1099-NEC and then reported to their tax returns.1 Dividends are recorded on 1099-DIV. The interest is written on the 1099-INT.

Though taxpaying taxpayers may be uncomfortable getting different tax forms, and companies may prefer to distribute them less frequently, 1099s must be kept on track of earnings that aren’t reported in an individual’s wages or the salary reported in the W-2. In fact, it is the case that the Internal Revenue Service (IRS) will match nearly all 1099s as well as W-2 forms (the wages-reporting forms you receive from the employer) with the tax return Form 1040 and other tax documents. If they do not match with the IRS, the IRS might inform you that you’re owed more money.

When to Issue a 1099

A form called 1099 is utilized for logging wages received by freelance workers or independent contractors. Many entrepreneurs need help figuring out what to do when they need to give the 1099 form to an individual contractor. Submitting it is a crucial part of tax compliance, and you should learn about this vital document for freelancers.

1099 Rules for Business Owners in January 2017

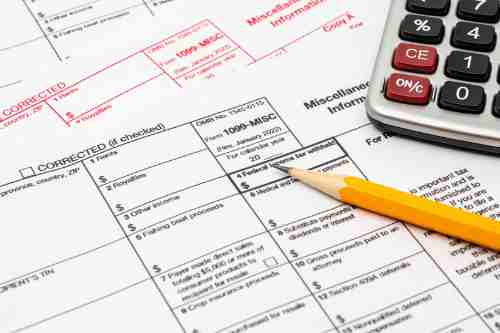

Due to the numerous modifications and updates to the 1099-MISC tax forms over the last few years, Many entrepreneurs need to be made aware of these rules. It is generally required to give a 1099-MISC tax form at any time:

A person is liable to pay a minimum of $600 during a calendar year in the event that this money or payment was in exchange in exchange for prize rental or service (including parts or materials).

A settlement in a lawsuit you’ve paid will require you to sign the 1099-MISC.

The form isn’t required to make personal payments but only for payments made by businesses.

Fines for not submitting the required 1099-MISC form can be between $30 and $100, based on the date you actually issue the document. The maximum penalty is $1.5 million annually for each company. Additionally, companies that choose not to adhere to this policy are assessed a minimum amount of $250 per application.

Who Requires a Form 1099?

This form should be sent to subcontractors or vendors for whom you have spent more than $600 during one calendar year. Does this include the estates of persons, limited partnerships or limited liability corporations?

Redesigned Form 1099-MISC

The IRS modified Form 1099-MISC in preparation for the tax year 2020 in order to allow for the development of a brand new Form 1099-NEC. It is a new form with distinct box numbers to report certain types of income. The business must provide the 1099-MISC form to their recipients by February 1, 2021, and then file it with the IRS on or before March 1 (March 31 for you to file electronically).

When businesses use Form 1099-MISC for reporting figures in Box 8, Substitute payments in lieu of Interest or Dividends, as well as Box 10, Gross Proceeds Paid to an Attorney, there’s an exemption to the standard deadline. These forms must be submitted to the recipients before February 16 2021.

New Form 1099-NEC

Form 1099-NEC is the new tax form that will be available in 2020 that allows for non-employee payments that are greater than $600 to an employee. The form must be submitted to the IRS either on paper or electronically and then sent to the recipients before January 1, 2021.

There needs to be an automatic 30-day extension for filing Form 1099-NEC. However, extensions to file are possible in certain circumstances of hardship. In addition, compensation for non-employees could be subject to withholding backup in the event that a person who is paying has yet to give an appropriate taxpayer ID number for the payor or if the IRS notify the payee it has a Taxpayer Identification Number supplied wasn’t correct.

Deadlines help fraud detection.

The deadlines for information returns, like Forms 1099-MISC or 1099-NEC, assist the IRS in better detecting fraudulent refunds by confirming the income reported by individuals in their tax returns. The taxpayer can aid in that process and avoid penalties when they file the documents on time and without mistakes. The IRS suggests e-filing as the most efficient, fastest, precise and efficient method to submit the forms.

Important IRS form 1099 due dates: An independent contractor needs to know

The IRS will constantly announce two deadlines for the entire 1099. Clients and taxpayers need to know both of them to ensure that they submit their tax returns for the relevant tax year on time.

- Date for submission due to taxpayers

Businesses and clients must mail all appropriate 1099s to taxpayers on time to utilize when they file their tax returns.

The date for clients to submit the form is January 31, 2023. If the deadline falls on a weekend day, the deadline can be extended until the following Monday or the next day if the Monday falls on the day of a holiday that is public.

There are some exceptions to the deadlines, like Form-MISC, which has some information inside box 8 or 10; however, the details are described in greater detail in the section below that will examine the due dates of specific 1099 kinds.

- The deadline for filing is the day before the IRS

The deadline for submitting forms for the IRS is different between taxpayers and customers. Small and medium-sized businesses, as well as clients, are required to submit the tax form to the taxpayer by the 31st day of January. Make sure they provide a copy to the IRS on or before February 28.

The submission deadline for tax returns depends on whether you’re sending your forms via mail or opting for the electronic file option.

The IRS will require that most 1099s be filed before February 28, 2023, by mail and before March 30 2023, if you file electronically. The exception is 1099-NEC, to be submitted before January 31.

What’s an Independent Contractor?

Temporary workers who offer products or services for a business upon contract terms are referred to as independent contractors. An independent contractor may be known as a temporary employee or employee with a 1099. It could be a corporation and companies as well as individuals. The majority of independent contractors get paid for each job. As a business owner, you do not have to pay the tax withholdings they make, and this can make it less expensive to employ freelance contractors as opposed to hiring an employee who is full-time and permanent. The correct classification of your workers and filling out the proper forms will help you avoid the hefty fees and penalties imposed by the IRS.

What’s the difference between the 1099-NEC and the. 1099-MISC?

What’s the difference between 1099-NEC and 1099MISC types? Before the tax year 2020 year, as a company manager who hired contractors, you primarily used Form 1099 MISC for reporting non-employee earnings. Beginning in 2020, it was decided that the IRS agreed to reinstate the 1099-NEC as the method for reporting self-employment income instead of the Form 1099-MISC. The reason for this was to make clear the fact that there’s a distinct time frame for filing taxes on compensation paid to non-employees in comparison to the filing deadlines for other forms of payment that utilize the form 1099-MISC.

The term “non-employee” can mean all compensation earned for work performed without being considered an employee. The time “freelancer” is used to describe an independent contractor or freelancer This is those who are employed by a firm and are able to determine the outcomes of work but cannot control the position or the method by which the work will be performed. Contractors must also be self-employed and pay taxes.

What can I do in the event of an error in my Form 1099?

If you get a 1099 Form that has an error, it’s crucial to contact the company as fast as you can and request for them to rectify the mistake.

In some instances, there is a possibility to rectify the mistake before mailing the wrong 1099 Form to the IRS.

If you’re an employer that filed an error on the 1099 Form, you’re required to complete a new version using the same procedure in which you submitted the original form. When you’re done, mail an official copy to the contractor you hired, which they can then use to submit their tax return.

For more information on tax deductions, check out our tax deduction calculator for self-employed employees and contractors.

When you use TurboTax Live Full Service Premium, you can have a professional identify every deduction in tax and submit tax returns for self-employment as well as investment to your satisfaction. Backed by our Full Service Guarantee. Taxes can be filed by yourself with TurboTax Premium. The TurboTax Premium team will search for 500 tax credits and deductions for you to give complete coverage.