Businesses need to understand the contra-accounts to maintain accurate accounting records. Additionally, they allow us to apply the concept of matching. The expense accounts are characterized by an average debit balance, which increases as you debit transactions. A contra account decreases the related account, in this example, an expense account. A contra account is guaranteed to possess an average balance different from the parent account. So, a counter account linked to an expense account will carry an average balance on credit.

Compared to other contra accounts, accountants often use contra expense accounts for companies, as the aim is to earn money. But, it is essential to spend money to generate income, as the old phrase goes. Therefore, owners of businesses should keep track of their business costs. One way to achieve this is by organizing the accounting records.

If you’re trying to become more organized in your bookkeeping, It’s time to begin taking charge of the expense accounts. They are the accounts you use to record every expense of your business. Continue reading to learn more.

What is the definition of Accounts Expenses?

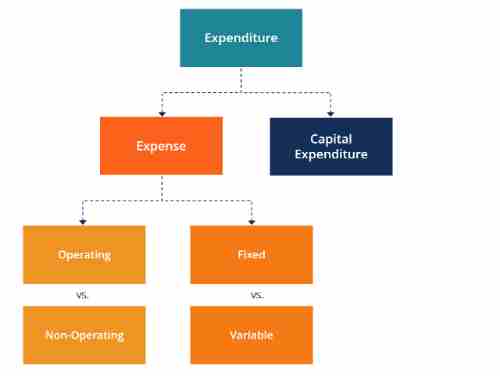

Accounting expenses are the amount of money spent on expenses or expenditures incurred to create profits. The expenses of accounting are the costs of doing business. They represent the total of those activities likely to generate an income.

It is essential to comprehend the distinction between “cost” and “expense” because they are distinct in accounting. Cost measures the monetary value (cash) utilized to purchase an asset. The term “expense” refers to an expense which has been retracted or used up in actions that generate income. So, every expense is a cost, but there are exceptions to the rule.

An example of an expense account

Consider an instance of a smaller business such as a bakery and how it could use several expense accounts.

Rent Expense account: The account records the expense of renting an area for the bakery. If the monthly rent is $2,000, the baker will deduct (increase) this Rent Expense account by $2,000 and then credit (decrease) the cash account with precisely the same amount every month.

Salaries and Wages Account It tracks how much employees are paid. If a monthly salary exceeds $8,000, the business debits this Salaries and Wages Expense account with $8,000 and then credits the same amount to the Cash account.

Utilities Expense Account: The account records the price of water, electricity, and other utility bills. If the cost of utilities for the bakery each month were $500, the bank would deduct from the Utilities Expense account $500 and then credit the Cash account with $500.

Supplies Expense account: The account tracks the costs of baking ingredients such as flour, sugar and yeast. If the bakery spends $1500 for supplies this month, the account will debit the Supplies Expense account by $1500 and debit the Cash account with $1,500.

Depreciation expense account: This account captures the costs of using longer-term equipment like baking ovens or mixers during the period. Suppose the depreciation expense for this equipment is $200. In this case, the bakery should debit the account for Depreciation by $200 and then credit the account for Accumulated Depreciation by the exact amount.

Operating expenses

Operating expenses refer to all expenditures incurred to earn operating revenue, including the sale of merchandise. Below are some examples of average operational costs.

Rent Smaller businesses that cannot afford a place to run their business typically rent a location from another. The monthly rent payments are counted as expenses. The floor and building are only some of what can be rented out. Businesses often rent automobiles and other equipment.

Earnings: Employers have to compensate their employees for performing functions within their company. The employees who produce products and others are involved in administrative tasks such as bookkeeping. The business pays all the employees in respect of their work and time. They are accounted for as salary or wages.

Utility costs include heat, electricity, water, and phone services. They are essential for any company to run.

Advertisement: Payments are made by a different company to market the products or services. Each company promotes its products or services in one manner or the other. The payments are categorized as operating costs because they aid in selling and generating operating revenue.

What is an Expense Account?

What is an account for expenses? If you can determine one expense account, you can discern the difference between what constitutes an expense account.

If you’re trying to find an expense account, look for the features listed below.

An expense account is utilized to track the expenses. The expenses can only be related to expenses for business. However, an expense account isn’t considered an account for personal use.

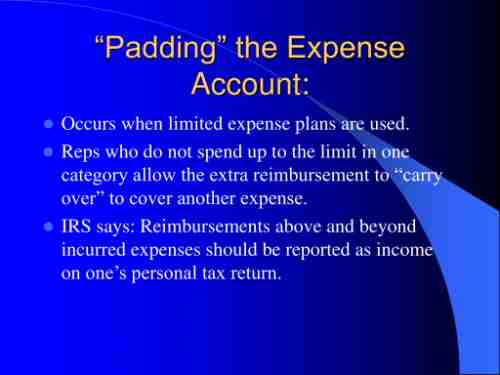

Companies typically create an expense account for a specific purpose to be considered. This could be, for example, recording expenses for travel or. The account has a particular limitation on the amount allowed to be billed for fees for the account.

Additionally, a person in the organization (a finance manager or business supervisor) generally oversees the expense account and tracks the expenditure.

Accounting for expenses: List of the expense

Creating an account for each expense, such as rent or insurance premiums, is possible.

To find a complete list of expenses within accounting, take a look at this accounting example:

Remember, this isn’t an exhaustive listing. You may have expenses requiring an additional expense category in your account, such as company loan repayments. Also, everything you pay for in connection with your business can be classified as an expense.

What’s the difference between cost and cost?

The terms “cost” and “expenses” are two terms people can use interchangeably; however, they differ in terms that differ. Most businesses use expenses to generate revenue. This means that the company typically will pay them in a series of instalments to support regular business activities. The cost usually is an all-in-one payment for the acquisition of the asset. The asset could be long-term and, therefore, not readily liquid, like land. Liquidity is the speed at which an asset can be converted into cash. Costs are all expenses. However, not all costs are considered expenses.

What is the best way to record your expenses?

There are two methods to track expenses: cash and accrual basis. Based on accrual, it is recorded as an expense following an activity or fulfilling obligations. In cash-based basis accounting, a company records the cost after paying the cash.

If, for instance, the company was billed for an internet invoice in July but then paid within August, according to the accrual method, it is an expense incurred in July. Cash method: Since the company made its payment on August 31, it is recorded as an expense in July.